Understanding the 2025 Social Security COLA Increase

The 2025 Social Security COLA increase is a significant event for millions of Americans who rely on these benefits for their financial security. The increase is designed to help recipients maintain their purchasing power in the face of rising inflation and the rising cost of living.

The Significance of the 2025 Social Security COLA Increase

The 2025 Social Security COLA increase is crucial for retirees and disabled individuals who rely on these benefits for their income. The increase helps to offset the impact of inflation, which erodes the purchasing power of money over time. The cost of essential goods and services, such as food, housing, and healthcare, continues to rise, making it challenging for beneficiaries to maintain their standard of living without an adjustment to their benefits. The 2025 COLA increase aims to provide some relief from these pressures.

Factors Influencing the Calculation of the COLA, 2025 social security cola increase

The Social Security Administration (SSA) uses a specific formula to calculate the annual COLA increase. The primary factor in this calculation is the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

The CPI-W measures the average change in prices paid by urban wage earners and clerical workers for a basket of consumer goods and services. The SSA compares the CPI-W from the third quarter of the previous year (July-September) to the third quarter of the current year. The percentage change in the CPI-W over this period determines the COLA increase for the following year.

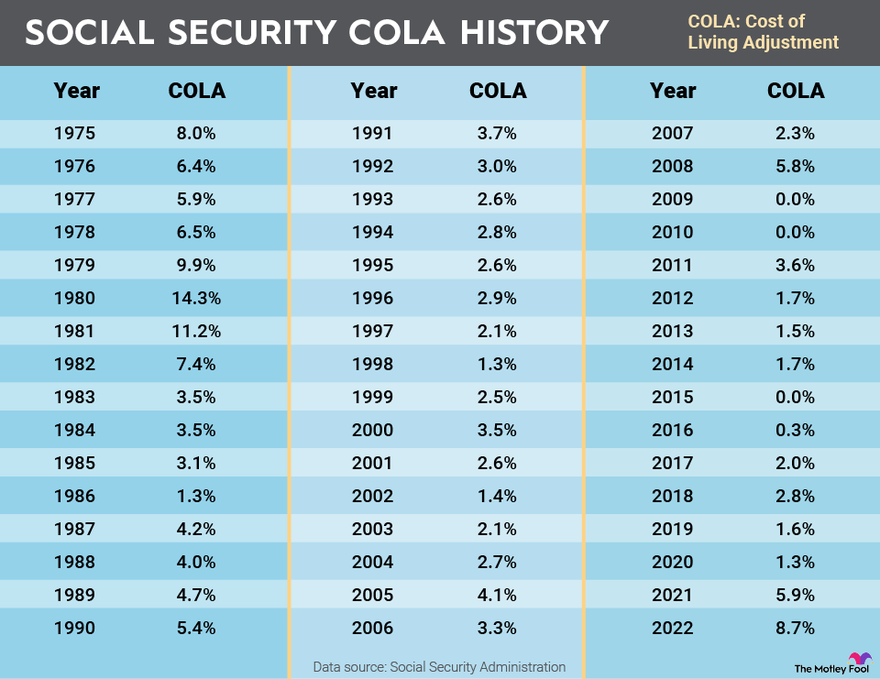

Historical Overview of Social Security COLA Increases

Social Security COLA increases have varied over the years, reflecting fluctuations in inflation.

The following table illustrates historical Social Security COLA increases:

| Year | COLA Increase (%) |

|---|---|

| 2023 | 8.7% |

| 2022 | 5.9% |

| 2021 | 1.3% |

| 2020 | 1.6% |

| 2019 | 2.8% |

The table highlights that COLA increases can be substantial in periods of high inflation, as seen in 2023. However, there have also been periods with smaller increases, such as in 2021, reflecting lower inflation rates.

Impact of the 2025 COLA Increase on Beneficiaries

The 2025 Social Security Cost-of-Living Adjustment (COLA) is designed to help beneficiaries maintain their purchasing power in the face of inflation. The increase is calculated based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which measures changes in the cost of goods and services for a typical urban household.

The COLA increase is expected to have a significant impact on the purchasing power of Social Security beneficiaries. While the increase aims to offset inflation, it’s important to understand how it might affect different beneficiary groups.

Impact on Different Beneficiary Groups

The impact of the COLA increase will vary depending on individual circumstances and the specific needs of each beneficiary group.

- Retirees: Retirees who rely heavily on Social Security benefits will likely see a noticeable improvement in their purchasing power. The increased benefits can help them cover essential expenses such as food, housing, and healthcare. For example, a retiree receiving $1,500 per month in benefits might see an increase of $150 per month due to the COLA, which can make a significant difference in their overall budget.

- Disabled Individuals: The COLA increase can provide crucial financial support for disabled individuals, many of whom face significant medical expenses and may have limited employment opportunities. The additional income can help them maintain their quality of life and access essential services.

- Survivors: Survivors who rely on Social Security benefits to support themselves and their families will also benefit from the COLA increase. The additional income can help them meet their financial needs and provide for their dependents.

Challenges in Maintaining Standard of Living

Despite the COLA increase, many beneficiaries continue to face challenges in maintaining their standard of living.

- Rising Healthcare Costs: Healthcare costs continue to rise at a faster pace than inflation, making it difficult for beneficiaries to afford essential medical care. Even with the COLA increase, many beneficiaries may struggle to cover prescription drugs, doctor’s visits, and other healthcare expenses.

- Inflationary Pressures: While the COLA aims to offset inflation, the actual increase may not fully compensate for the rising cost of living. The cost of food, housing, and other necessities can continue to outpace the COLA increase, putting pressure on beneficiaries’ budgets.

- Limited Income: Many beneficiaries rely solely on Social Security benefits, which can be limited in providing for all their needs. The COLA increase may provide some relief, but it may not be enough to significantly improve their financial situation.

The Future of Social Security and COLA Increases

The long-term sustainability of the Social Security program is a significant concern, given the aging population and economic trends. While the 2025 COLA increase provides much-needed relief to beneficiaries, it’s crucial to consider the program’s future to ensure its viability for generations to come.

Potential Challenges and Opportunities for Future COLA Increases

The future of COLA increases hinges on the program’s financial health, which is influenced by several factors.

- Aging Population: As the baby boomer generation continues to retire, the number of beneficiaries will increase, placing greater strain on the program’s finances.

- Life Expectancy: Increased life expectancy means beneficiaries will receive benefits for a longer period, further straining the program’s resources.

- Economic Trends: Fluctuations in inflation, interest rates, and economic growth can impact the program’s revenue and the ability to fund COLA increases.

- Program Solvency: The Social Security Trust Fund is projected to be depleted by 2034, raising concerns about the program’s ability to pay full benefits to all beneficiaries.

Policy Changes and Reforms to Ensure the Adequacy of Social Security Benefits

Several policy changes and reforms can help ensure the adequacy of Social Security benefits in the future.

- Raising the Retirement Age: Gradual increases in the retirement age can align benefit payments with increased life expectancy and reduce the strain on the program’s finances.

- Increasing the Taxable Wage Base: Expanding the portion of wages subject to Social Security taxes can generate additional revenue to support the program.

- Investing Trust Fund Reserves: Allowing the Trust Fund to invest in a broader range of assets, such as stocks, could generate higher returns and bolster the program’s financial stability.

- Means-Testing Benefits: Implementing means-testing, where benefits are reduced for higher-income beneficiaries, can help ensure that benefits are distributed equitably and efficiently.

The Role of Policy Changes and Reforms

Policy changes and reforms play a crucial role in ensuring the long-term sustainability of Social Security and the adequacy of COLA increases. These changes should be carefully considered and implemented to balance the needs of current and future generations while preserving the program’s integrity.